In the bustling world of insurance sales, knowing how to improve sales performance can be the difference between leading the pack and lagging behind.

With Forbes reporting that highly engaged sales teams are 21% more profitable than their less engaged counterparts, the stakes couldn’t be higher.

But how did we bridge the gap?

It wasn’t by chance. We honed in on a secret weapon: my activity tracker. This piece isn’t just a list of strategies; it’s a blueprint for revolutionizing your sales performance from the ground up.

That’s why, in this blog, I’m pulling back the curtain on the game-changing tactics that elevated my team from good to great.

Dive in, and let’s explore how you can replicate this success in your own team.

10 Strategies I Used to Improve My Insurance Team’s Sales Performance

Diving into the core of our success, here are the ten transformative strategies that elevated my insurance team’s performance, leveraging the power of my activity tracker.

1. Take a People-First Approach

The heart of my strategy? It’s simple: focus on the people. Whether it’s your clients or your team, understanding their needs, fears, and ambitions makes all the difference.

This approach helped me tailor my sales tactics and management style to suit my team better, encouraging a more motivated and engaged group.

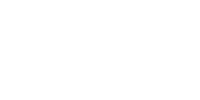

2. Train Your Team

Training isn’t just about the nuts and bolts of insurance; it’s about mindset, too.

I drilled into my team the importance of seeing each call as an opportunity, not just a task. By understanding the “why” behind their actions, they started making each call count.

Let me break it down for you: understanding your Per Activity Income, or PAI, is a game-changer in our line of work. It really opens your eyes to what we’re actually doing here.

Take it from me: finding out I was pulling in $17 for every call I made, regardless of whether I sealed the deal or got a harsh no, was a real eye-opener. Made me think, “Why not dial more?”

So, I throw this question at my agents, “What if I gave you a buck for every call you made? How many would you crank out in a day, and how early would you start hitting those phones?” You should see their faces—answers range from the wild “I’d skip sleep for 200 days!” to the absurd.

Then, I get down to the brass tacks with their actual figures, and guess what? They’re already making $10 a call. Suddenly, the big question pops up, “You were ready to circle the globe for a dollar, yet here you are, making ten times that, and you’re holding back. Why’s that?”

It’s all about putting things into perspective, showing them the real value of their efforts, and then nudging them to up their game.

If you’re itching to find out how to mold the ultimate insurance agent, you gotta dive into my piece, ‘Insurance Agent Training: Start Your Insurance Career in 2024.’ This is filled with information on how to get started.

3. Have Regular One-on-One Meetings with Each Team Member

I make it a point to sit down with everyone on my team regularly. These aren’t just check-ins; they’re deep dives into their performance, obstacles, and goals. It’s about showing them their potential and how to reach it.

Leaderboards are a common tool used within sales teams and, in theory, seem like a simple way to motivate lower-performing reps to sell more and higher-performing reps to maintain their top positions.

Assuming that their Per Activity Income (PAI) numbers will stay the same, just like a close rate percentage, I can take the bottom half of my leaderboard and multiply their PAI by the top performer’s activity to show them what their potential is each week.

I’ll compare week one of the previous month to week one of the current month to see how our growth is tracking and every year I’ll sit down with all my agents to set their income goals, using PAI to project how many dials and appointments they’ll need to make.

4. Have and Enforce Core Values Within the Team

when we look at those leaderboard numbers, it’s easy to get caught up in thinking that the top dogs have advantages—be it experience, their skill set, or maybe they’re getting credibility when it comes to leads, or heck, maybe they just got lucky. But when we really dug into it, the truth couldn’t be more straightforward.

What sets the top performers apart? It’s their hustle—their sheer volume of activity. Sounds too simple, right? But sometimes, the most profound truths are the simplest ones.

So, when any of my agents come to me, hungry to boost their numbers, my advice is as direct as it gets: “Do more.” That’s it. There’s no magic formula, no secret handshake. It’s about getting down to brass tacks and putting in the work.

5. Don’t Become Complacent

The moment you think you’ve got it all figured out is the moment you start losing ground. I constantly challenge my team (and myself) to push beyond their comfort zone. Complacency is the enemy of growth.

6. Set Attainable Operational Objectives

Goals are good, but realistic goals are better. I set targets that stretch my team but are still within reach. This way, they see progress and stay motivated rather than getting discouraged by the impossible.

7. Hire Effective Candidates

Bringing on the right people is crucial. I look for individuals who aren’t just skilled but are also a good fit for our team’s culture. Skills can be taught, but attitude and work ethic? Those are gold.

8. Embrace Technology and Digital Transformation in Sales

Technology is our friend, especially in the sales game. From our activity tracker to CRM tools, we use tech to streamline our processes, track our progress, and stay ahead of the curve.

9. Tracking Sales Activities

At the heart of our approach is the activity tracker, a tool that’s been a game-changer in how we assess, understand, and enhance our sales processes. It’s not just about having data; it’s about having the right data and knowing what to do with it.

Sales Call Tracking

When it comes to sales call tracking, this isn’t about tallying up calls made; it’s about understanding the impact of each call.

We dive into metrics like call-to-appoint ratio, identifying not just quantity but quality of interactions. This insight helps us refine our approach, ensuring we’re not just busy but effective.

For an in-depth dive into enhancing your agency’s performance through strategic sales call tracking, check out my piece on ‘Maximizing Revenue By Tracking Sales Calls: My Success Story.‘

Sales Lead Tracking

Lead tracking within our activity tracker goes beyond the basics. We’re analyzing how many touches it takes to convert a lead, the average time from initial contact to conversion, and the effectiveness of different communication strategies.

This level of detail enables us to optimize our lead management process, significantly improving our conversion rates.

Total Hours Worked

The tracker also sheds light on the total hours worked by each team member, correlating it with output.

This isn’t about clocking in and out; it’s about understanding the relationship between time invested and results achieved, helping us promote efficiency and a healthy work-life balance.

Deposits

Monitoring deposits through the tracker offer us a clear view of financial outcomes related to sales activities.

By understanding the income generated from specific actions, we can better allocate our resources and efforts where they’re most effective.

Earned Money per Activity

This is where we connect the dots between activity and income. By breaking down earnings per call, per appointment, or any sales-related action, we’re able to identify the most lucrative activities, guiding our team to focus their efforts more strategically.

Recruitment Tracking

Lastly, our approach to recruitment has been revolutionized. We’re not just tracking the numbers of recruits; we’re evaluating the effectiveness of our recruitment strategies, understanding the characteristics of successful team members, and refining our approach to attract top talent.

10. Sales Data Analysis

You think hitting those sales targets is just about putting in the hours? Think again. We’re all about getting into the nitty-gritty of our sales data, thanks to the activity tracker.

It’s like having a GPS for our sales strategy—shows us where we’re at, where the gold mines are, and how to steer toward them. This isn’t just about grinding; it’s about grinding with a roadmap.

Keen on slicing and dicing your sales data to find your own gold mines? Swing by “How To Do Insurance Sales Data Analysis Right: 7 Key Metrics” for the insider track on turning numbers into nuggets.

Bottom Line

As we wrap up this journey through the strategies that revolutionized my insurance team’s sales performance, it’s clear that success in this field is no accident.

It’s the result of intentional actions, strategic planning, and the right tools—like my indispensable Activity Tracker.

So, take these insights, put them into action, and watch as your team’s performance reaches new, unprecedented levels.

Here’s to your success and the continued growth of your insurance sales team!

FAQ

How to be successful in insurance sales?

If you’re aiming to knock it out of the park in insurance sales, remember it’s all about the rapport you’ve got with your clients. A solid relationship is your bedrock.

Then, don’t shy away from getting your hands dirty with digital marketing – it’s the bread and butter of reaching out today.

Stick to these, and you’ll find yourself not just surviving but thriving in the insurance hustle. For a more detailed approach, go through my blog “Why Activity Matters More Than Talent in Insurance Sales – The Ultimate Action Plan for Sales.”

How do I build an insurance sales team?

Celebrate the victories, big or small, because recognition fuels motivation. Foster a sense of camaraderie – it’s us against the world, right?

Opportunities for growth are like the gym for your team’s skills, so don’t skimp on development. Be the leader who’s always got an open door; approachability builds trust.

Get these elements right, and you’ve got yourself a team culture that’s all about pulling together for the win.